At some point in the last few years, it's a safe bet to assume that a vast majority of us were forced to confront our relationship with finances. You may have been very practical, setting up your basic financial system. You could even have gotten advanced and built a way for your money to work for you. But what happens when you go through moments of temptation? When you feel that sense of stagnation, that your financial boundaries are restricting your opportunity to truly live?

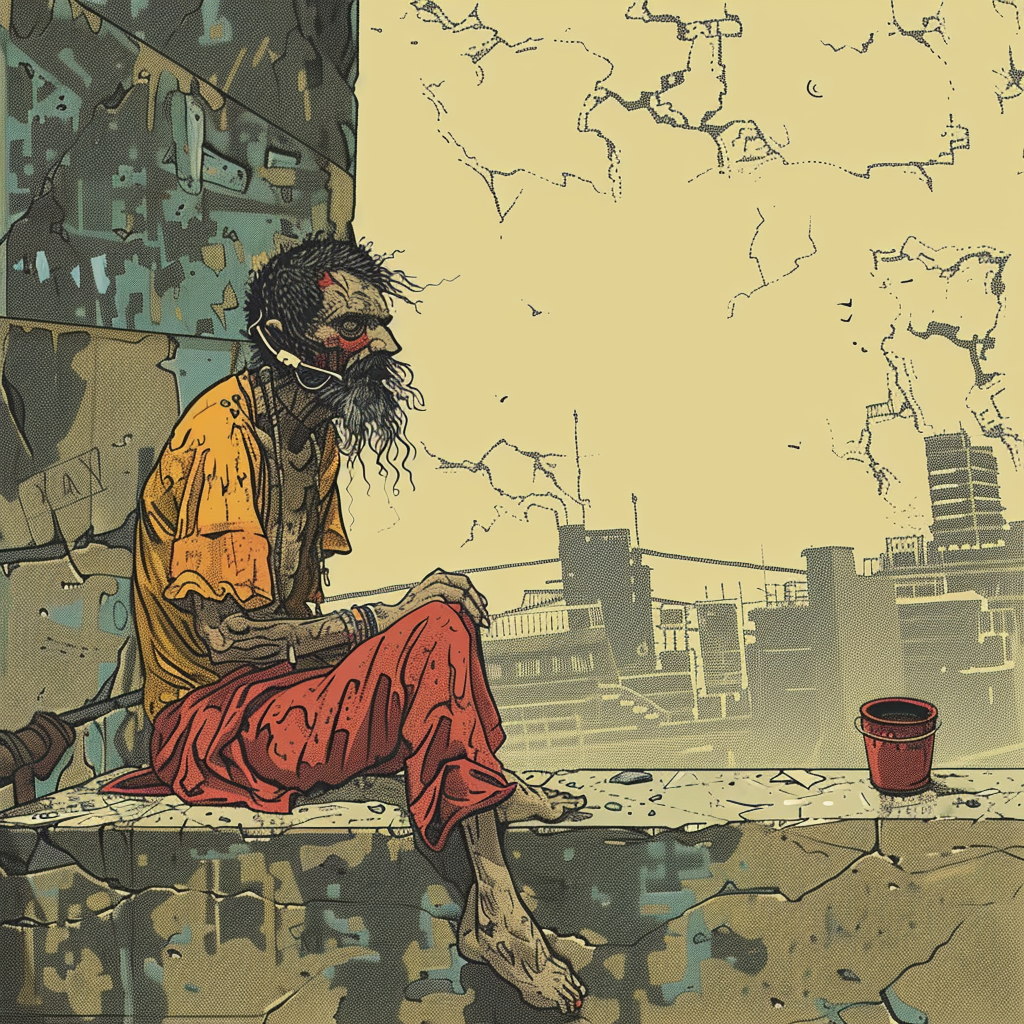

At certain points in our lives, if we haven't already, we will come face-to-face with some version of poverty. A timeline in our life when expenses are tight, income isn't what you'd like, and debt is a constant loom. And it's moments like these where the focus on philosophy has really helped me remember what I'm doing this for.

Through this read, I will present to you 4 principles of Stoicism and how they can be used to rewire your mind to stay financially vigilant.

The Stoic Virtue of Wisdom

Use it or lose it: Make the most of what you have. When you're buying something new, ensure that you choose something of high quality that can last. Any item you purchase should ideally have more than one use. Learn about what you truly need.

Learn what you don't know: Instead of paying others to augment your lack of skills, invest in your own self-education. Learn new skills that will enable you to accomplish basic tasks yourself.

Barter is a viable option: Not everything needs to be purchased from a store. Understand your skill set, and then learn how to barter those skills for goods or services. Mow someone's lawn for a haircut, set up a website for someone in exchange for a couple of home-cooked meals.

Learn Basic Repairs: Almost everything in your home can be fixed by your own hands. Washing machines, dryers, food processors, vacuums - in most instances, all they need is the right part. Adapt your purchasing habits to buy accessories that can be repaired, rather than thrown away.

Cook from Scratch: The hidden cost of processed foods is in your health. They also cost more than making the same foods at home at a higher quality. With flour (white, multigrain, rye, corn), eggs, and milk as your base, you can make all of the following: Pancakes, Dumplings, biscuits, flatbread, crepes, French toast, pudding, egg noodles, custard, muffins, scones, quiche, fritters, gravy, clafoutis, omelets, and cornbread.

The Stoic Virtue of Courage

Cut your own hair: Enhance self-reliance and save money by learning to cut your own hair or doing it with a friend.

Exercise daily: Regular exercise benefits almost everyone and yields generous returns for those who make it a habit. Most exercise doesn't require extreme spending.

Forage for Food: Join online groups that teach foraging techniques. Food can be found throughout the landscape, even in urban areas. An app called "Too Good to Go" parters with restaurants to offer tons of excess food.

Negotiate Prices: Instead of accepting prices as offered, have the courage to negotiate for a fair price or walk away if needed. It doesn't apply for stores, but definitely on Marketplace and other non-traditional outlets.

Use food pantries: You need food and they have food; go get food.

The Stoic Virtue of Community

Share resources: Collaborate with neighbors or family members to share resources such as lawnmowers, compost piles, or food exchanges. You may excel at making cheese while your neighbor specializes in baking cookies.

Community Gardens: Engage with your neighbors to identify communal gardening spaces in your community. Building a garden with your community is not just a bonding experience, but a learning experience.

Buy in bulk with your neighbors: Explore online bulk food co-ops and coordinate with your neighbors to purchase staple products in bulk. This approach not only saves money but also fosters a stronger sense of community and benefits everyone involved.

The Stoic Virtue of Discipline

Ration Electricity and Water: Utilize only the necessary amount of electricity to conserve resources and reduce expenses. Implement water-saving practices such as harvesting rainwater, fixing leaks promptly, and being mindful of water consumption.

Limit Eating Out: Reserve dining out for special occasions rather than making it a regular habit.

Use Leftovers: Make the most of food by creatively using leftovers to prepare nutritious and flavorful meals, such as soups made from vegetable cut-offs or bones.

Buy Secondhand: Prioritize purchasing pre-owned items until your finances are stable, avoiding unnecessary expenses on new products.

Walk or Bike: Opt for walking or cycling whenever feasible to reduce reliance on motorized transportation and promote physical activity while saving money on fuel or public transportation fares.

Replace Impulse Buying with Debt Repayment: Instead of impulsive purchases, allocate the funds towards repaying debts to maintain financial discipline and progress.

Know Where Your Money Goes: Regularly review your budget to track expenses and make necessary adjustments to align with your financial goals.

By incorporating these principles into our daily lives, we not only strengthen our financial well-being but also cultivate a deeper sense of fulfillment and purpose. It's important to remember that stoicism has been around a lot longer than we have. While embracing these principles may not get you out of poverty, they'll provide you with the mindset to sustain yourself and keep moving.